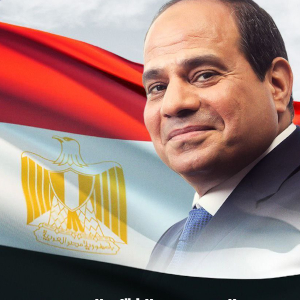

Unsurprisingly Abdel Fattah Al-Sissi, in power in Egypt since he overthrew the Islamist Mohamed Morsi in a coup in 2013, was re-elected as president again for another six-year term. The election was fast-tracked because holding the election in 2024 amid a projected worsening economic crisis could have constituted a bigger political problem for president el-Sissi. The election authorities reported that the latter won his third presidential election, with 89.6% of the votes, a figure that obviously makes no sense. Many accuse the government of having committed massive election fraud. As president Sisi enters his third term, what kind of problems should we expect. Perhaps the question from an outside perspective is should we expect the government to stabilize the country in the years to come? And the answer is a resounding no.

So what are some of the areas to watch in 2024 and beyond?

Firstly, there the domestic security: Although the insurgency in the Sinai Peninsula has been somewhat curtailed, it remains a significant risk across Egypt, particularly in North Sinai. ISIS affiliates in Egypt’s Sinai Peninsula continue to pose a threat.

In its immediate neighborhood, the country faces heightened security problems near its borders, be they along Israel and Gaza to the east, Libya to the west and Sudan to south. The country surrounded by unstable neighbors.

To the east, Egypt has concerns about the displacement of Palestinians and regional security issues. The country is also dealing with tensions due to Israel’s concerns about underground tunnels beneath the corridor that potentially link Gaza to the Sinai.

The Israeli government has been quietly pushing for Egypt to admit large numbers of Gazans, despite not publicly calling for such measures. This move has been met with resistance from Egypt, which has backed Israel’s blockade of Gaza since Hamas took over in 2007.

Egypt has rejected allowing an influx of refugees from Gaza, citing concerns about the displacement of Palestinians, and all these issues are not likely to vanish anytime soon. In this case, the Egyptian diplomacy has no answer to the problems there.

Still in the east, the Houthis have been playing a significant role in Egypt’s security. Based in Yemen, the Houthi’s potential to disrupt maritime traffic in the Red Sea poses a direct threat to the Suez Canal, which is a vital economic lifeline for Egypt. The Houthi’s targeting the interest of Israeli, which is a partner of Egypt, is another concern. These attacks could potentially strain Egypt’s relations with Israel and complicate regional security dynamics.

To the west, the Egyptian-Libyan border is over 1,200 kilometers long and is almost entirely open desert, making it virtually impossible to secure. The breakdown of the Libyan state, crumbling of border outposts, and rise of warring militant factions in Libya all threaten Egypt’s tenuous internal stability. Egypt is also dealing with the influx of foreign fighters operating in Libya, making its western border a permanent source of concern. Here too Egypt has no diplomatic response and this clearly weakens the position of President Sissi who’s foreign policy has been ineffective, in particular specific to Libya where his support to eastern Libyan warlord Khalifa Haftar, the exit of Sisi’s French ally (former FM) Jean Yves Le Drian from the French government and the fast moving changes taking place in the Middle East have not helped Cairo.

To the south, Egypt is dealing with the fallout of the Sudanese crisis, with many Sudanese fleeing Sudan’s capital, Khartoum, and some ending up in Egypt. The management of Egypt’s borders with Sudan is a crucial concern for Cairo, as in the past Egypt has suffered serious consequences from the infiltration of militants and undocumented migrants, and the smuggling of arms and drugs.

Secondly, social unrest could lead to more instability and part of the problem is the worsening health profile of the population as insecurity and poverty will continue to expand.

And more importantly, setting aside bad governance, Egypt is grappling with a profound economic crisis that’s already disrupting its domestic, economic, and foreign policies. This crisis can contribute to deepening public discontent in 2024 and exacerbate social instability.

The country is bleeding billions of dollars, coming from the fact that it has a trillion-dollar debt. The situation is so drastic that Egypt has announced a sweeping program of spending cuts in exchange for hundreds of millions of dollars the International Monetary Fund allocated it as part of a major economic rescue package, which I assume will have little to no positive impact on Egypt in the long run.

Subsidies that help millions of Egyptians access cheap rice, oil and sugar have been reduced and will be reduced further in 2024- increasing the political risk on the Sisi regime, which has been making strategic mistakes such as spending $50 billion on building a new capital.

Across the country, families have reduced their consumption of meat, medicines, and clothing. Bread, rice, and cooking oil are among the items that are in short supply because when people are unable to buy pricey products like beef, they naturally shift to the more items, therefore creating more demand for the low-price products and a new cycle of shortages.

With a debt exceeding a thousand billion dollars, Egypt can no longer meet its various financial obligations. Egyptian authorities recently announced that they would delay various projects that required significant borrowing in US dollars and that they would reduce travel, training and conferences for civil servants.

These decisions were made after the government agreed to privatize dozens of state assets to international investors. The IMF has in fact conditioned its aid – $3 billion in loans over four years – on measures to reduce the role of the State and the privatization of companies belonging to the army as well as the adoption of a more flexible exchange mechanism.

Even with $700 million in loans expected from the IMF this year, Egypt will have to speed-up its privatization program to fill a financing gap of more than $5 billion. It will have to sell $2 billion in public sector assets and borrow more than $1 billion each from the World Bank and China Development Bank to help close the gap.

The Egyptian government attributes the economic chaos to the Covid-19 pandemic which clearly did hurt the tourism sector. They also blame the war in Ukraine which sent the prices of raw materials and agricultural products soaring, pushing the country into full economic crisis. The Egyptian pound has weakened against the US dollar, making imports of wheat, electronics, and cars more expensive. As a result, annual inflation reached 21.3% in December, a five-year high according to the government.

The Egyptian pound continues to fall against the US dollar, down 44% over the past year. A dollar was last worth between 30 and 31 Egyptian pounds. The decision to delay state projects risks penalizing the construction of a huge new capital on the outskirts of Cairo.

Authorities are trying to impose restrictions in the use of foreign money. With the exception of the foreign ministry, the security services and the military, all spending involving foreign currencies will go through Special authorization from the country’s finance ministry.

As president Sisi looks set to governed over the next 6 years, he will be facing an extraordinary situation as nearly $100 billion in foreign and domestic debt will come due for Egypt over the next four years. Egypt will have to repay $155.7 billion to foreign creditors, according to the country’s central bank.